PM Summary – 90% downside in the BLNK of an eye

- Blink Charging (BLNK) is an owner and operator of electric vehicle charging infrastructure whose stock has appreciated 505% since June on TSLA’s meteoric rise, increased Robinhood attention and potential that we will show is likely unrealistic

- BLNK’s origins trace back to a 2009 reverse merger with ties to Barry Honig whom settled with the SEC for $27MM for “classic pump-and-dump schemes”. In addition to the potential Honig connection, CEO Michael Farkas’s ties to other alleged pump and dump artists and SEC charges of its 2nd largest shareholder lead us to believe that the people behind BLNK could present serious risks

- BLNK’s core assets come from the 2013 asset acquisition of bankrupt EV charging company ECOtality – it has no technological IP; as such, BLNK’s revenue growth has significantly seriously lagged the EV industry – yet CEO Farkas made >$7m in compensation during this period

- We believe that this is due to persistent issues around product quality, customer churn, and user experience, and believe that these issues will continue to hamper BLNK’s growth

- We believe BLNK’s management team and underlying products do not justify its 46x FY20 revenue, and assign a ~$1 base case price target to the stock, down 91% from here

Executive Summary – BLNK’s origins as a reverse merger in the orbit of SEC-charged pump-and-dumpers combined with its acquisition of inferior assets out of bankruptcy are a significant risk to investors

Blink Charging (BLNK) is an owner and operator of electric vehicle (EV) charging equipment and networked EV charging services proclaiming to capitalize on the ever-growing EV industry. However, this report aims to prove otherwise and bring question into the people and underlying business. BLNK’s performance in the EV market has been tepid and is obscured by consistent promotion and retail mania over the EV space.

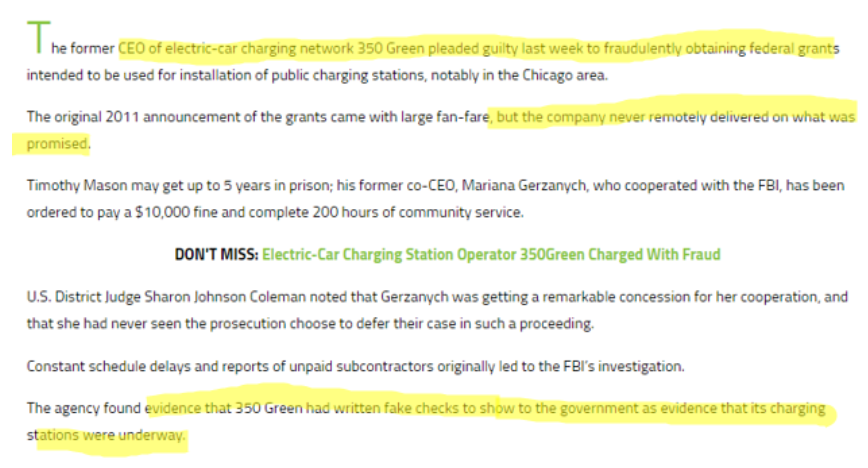

BLNK began as Car Charging Group, a 2009 reverse merger starring SEC-charged Barry Honig (more on him later) that in 2013 acquired the Blink assets from ECOtality, a charging station business that went bankrupt despite being the beneficiary of over $100MM in government grants. That same year, BLNK also acquired Beam LLC and 350Green, both subscale companies where the CEO of the latter company was charged with fraudulently obtaining federal grants. We believe that the management team and underlying asset base are a significant cause for concern.

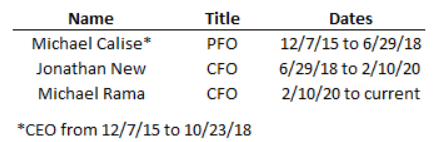

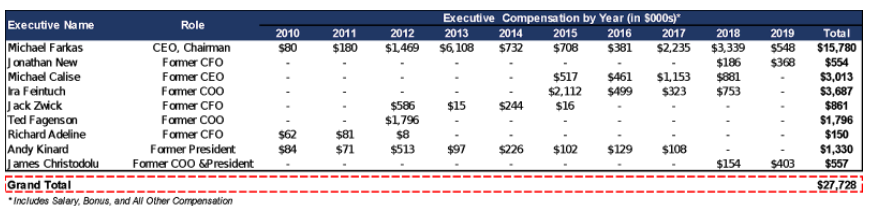

To begin with, CEO Michael Farkas appears to step in as a controlling shareholder when Honig and company sold out of the stock in the 2010-2011 timeframe as it skyrocketed up and subsequently collapsed. Farkas was previously the principal shareholder of an entity whose executives were charged with a pump-and-dump scheme, and whose assets were caught smuggling cocaine. Despite this questionable background, he collected over $7MM in compensation from Blink through 2015-2019 for near no growth, which has broadly lagged the broader EV space. Management concerns extend to the fact that the company is on its third CFO since 2015, and it has disclosed a material weakness in internal controls over financing reporting. It seems like this lack of oversight and controls could allow an unscrupulous management team to present dubious figured or pay itself excessive compensation (which they did, over $27m of compensation since inception).

For a “technology” company, BLNK doesn’t even have a P&L line item for R&D spend, and has what appears to be minimal technology related IP – it has just 4 active US patents, all of which came from the ECOtality deal. The patents (USD626063S1, USD674334S1, USD626065S1, USD626064S1) solely pertain to the visual design of their stations, not the underlying technology (note to reader: unless you are Apple and we’re talking about the iPhone design, visual design patents don’t have much value). This stands in stark contrast to competitor ChargePoint, who has about 59 patents assigned, several of which are related to their technology. User reviews of the chargers suggest poor maintenance, low functionality, and high fees – a major hindrance when TSLA, has a network of free (in some cases) rapid chargers for its fleet of cars, which lead EV sales in the US. Our proprietary research shows that charger counts have FALLEN at two key customers since the ECOtality deal, making us question the level of effort BLNK’s management has taken to grow the business. Not to mention at least one client BLNK claims that doesn’t appear to have BLNK chargers…

All this makes us question the ability of this business to be competitive and causes us to question the legitimacy of the price move from approximately $2 to over $10 over two months. Combined with revenue growth well behind that of the EV industry and the proximity of alleged pump and dump artists to the company lead us to believe that the stock is unsupported by fundamentals and the price move is entirely unjustified. We assign a price target of approximately $1 to BLNK, representing downside of 91%, and caution shareholders against chasing this stock.

Company ties to alleged pump and dumpers starring the infamous Barry Honig

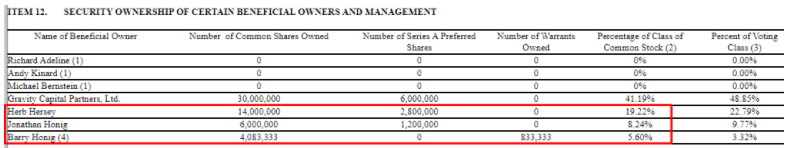

BLNK has its origins in Car Charging Group (CGGI), which itself is the product of a 2009 reverse merger with a Nevada shell known as New Image Concepts. In its 2009 10-K ownership table, we find that 33% of the company is owned by none other than Barry Honig (yes, that Barry Honig), his son Jonathan Honig, and father-in-law Herb Hersey:

Recently, and unrelated to BLNK, the SEC alleged that Barry Honig and other codefendants, “amassed a controlling interest in the issuer, concealed their control, drove up the price and trading volume of the stock through manipulative trading and/or paid promotional activity, and then dumped their shares into the artificially inflated market on unsuspecting retail investors…Across all three schemes, Honig was the primary strategist, calling upon other Defendants to, among other things, acquire or sell stock, arrange for the issuance of shares, negotiate transactions, and/or engage in promotional activity.”

Barry has a certain way with companies, and that way is usually down a lot, by near 90%:

In fact, in the 2009 filing, we learn that CGGI hit a low of just $0.002 that year, climbing to $1.01, thereafter rocketing to $75 sometime in 2010, only to collapse to $1.00 low in 2011 – a 97% drop in split-adjusted price from $2250 on 12/31/09 to $68 at 12/31/11:

Not only was the origin of the company related to a pump and dump artist, current management also has ties to similarly accused individuals.

CEO Michael Farkas’s ties to alleged pump and dumpers and penny stock dealers

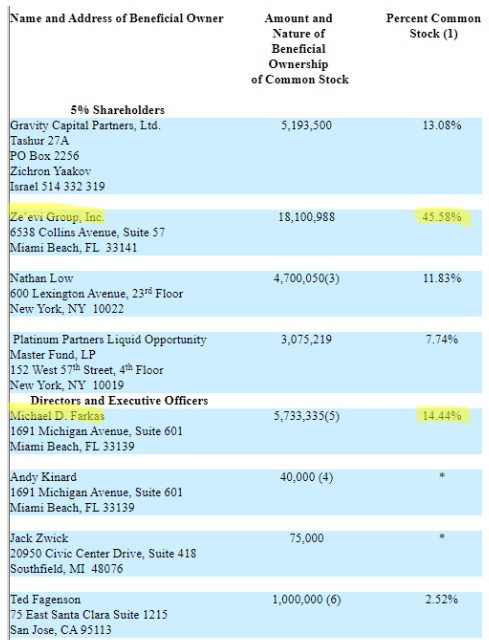

In 2011, and unsurprisingly in the context of the Honig SEC complaint, we see that Honig and his associates disappear from CGGI’s ownership:

Two new names emerge, Ze’evi Group and Michael Farkas – Farkas, it turns out, “has served as our Chief Executive Officer and as a member of our board of directors since 2009” (but is not shown as a beneficial owner and not mentioned once in the 2009 10-K, which cites Belen Flores as CEO). In fact, Farkas appears to have been named CEO in an April 30, 2010 filing. If BLNK’s own filings can’t accurately represent when Farkas became CEO, should they be relied upon for other information?

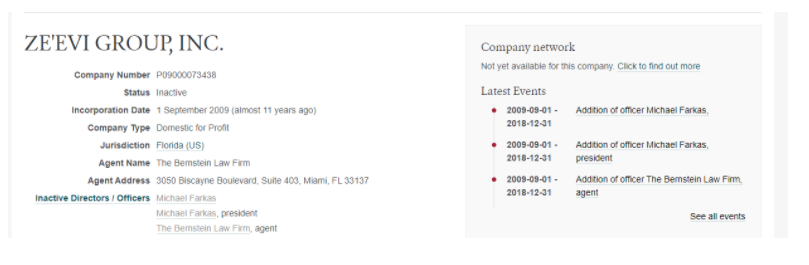

But the story gets stranger – in the 2013 10-K, we learn that Farkas in fact, controlled Ze’evi Group, controlling just over 44% of CGGI in at the end of 2013. Corporate records show that Farkas was actually an officer of Ze’evi Group going back to 2009, which would imply that he controlled approximately 60% of CGGI once Honig and co blew out of the name. We can only speculate as to what relationship Farkas has or had with Honig, but we can say that based on the stock performance of other Honig names, stepping into a post-Honig situation could lead to tears.

Farkas appears to have hidden his initial control over the entity as its stock price cratered in 2011, which makes us wonder what role, if any, he had in helping the Honig crew exit their holdings.

Why is this important now? Farkas, as we will show later, as current CEO since 2018 and prior CEO from 2010 to 2015, has presided over growth far behind that of BLNK’s industry and made acquisitions which appear to have created little, if no, value for BLNK shareholders. But before that, we show that Farkas has been in proximity of some questionable, if not outright illegal, activities.

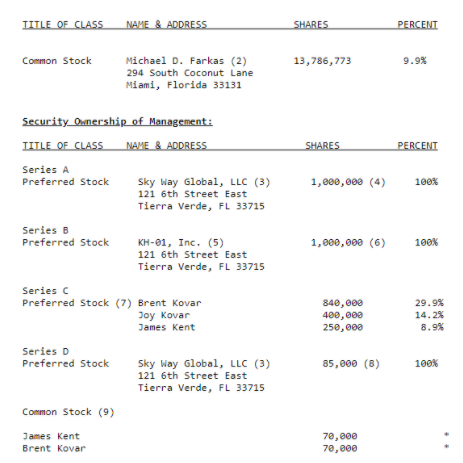

In 2009, the SEC accused Brent Kovar and Glenn Kovar, among others, principals in a company known as Sky Way Global, LLC, of “defrauding investors through multiple so-called ‘pump-and-dump’ schemes”, “timing stock sales from at least 2002 until 2005 to news releases that claimed President George W. Bush and others had endorsed company technology that would protect airplanes from terrorism.” In 2003, Sky Way Global itself was merged into a public shell to become known as SkyWay Communications Holding Corp. Michael Farkas, it turns out, was characterized as SkyWay’s “principal shareholder”, owning almost 10% of the company:

And if the Kovar pump-and-dump was not enough, Skyway was involved with potential drug trafficking:

“In 2006 an airplane Skyway said it had acquired in exchange for stock was caught in Mexico with 5 1/2 tons of cocaine on board.

In an email Friday, Farkas said, “Skyway was thoroughly investigated by several government agencies although there were indictments given to others, I was never accused or charged with any wrong doing.”

We are certainly not alleging that Farkas had anything to do with smuggling cocaine, but the actions of a company that he was principal shareholder of dictate the level of skepticism with which investors should view his ventures.

Farkas reminds us of Pigpen from Peanuts, with a cloud of “something” just following him around – BLNK’s second largest shareholder Justin Keener (9.9% ownership), was recently charged by the SEC for “failing to register as a securities dealer with the SEC. Keener allegedly bought and sold billions of newly issued shares of penny stock, generating millions of dollars in profits.”

Management quality can present risk to investors

To recap, BLNK and Farkas have been in some proximity to:

- Barry Honig, who was accused of and settled pump-and-dump charges

- Brent Kovar and Glenn Kovar, who were accused of “defrauding investors through multiple so-called ‘pump-and-dump’ schemes” – Farkas was involved as a key investor in the entity

- Justin Keener, BLNK’s #2 shareholder, who was charged by the SEC for being an “Unregistered Penny Stock Dealer”

And let’s not forget Balance Labs (not to be confused with BLNK), which Farkas owns 88% of, has collapsed from over $3 in 2016 to just $0.75 at the end of 2019 (it barely trades now, calling into question whether it has any value):

With so many EV companies out there, why invest in a company with questionable individuals with less than stellar track records? We continue to dive deeper in the story and find even more issues internally with the company…particularly with governance and management turnover.

Executive turnover and a material weakness leaves investors exposed

It should perhaps come as no surprise that over the last four years, BLNK has gone through 3 principal financial officers/chief financial officers and has seen several board members resign, including Kevin Evans, who resigned under the following circumstances: “To the knowledge of the Company’s executives and Board members, Mr. Evans resigned due to a failure to find common ground with the Executive Chairman [Michael Farkas]”

And if all this were not sufficiently concerning, BLNK has a material weakness in its internal controls over financial reporting, specifically “related to lack of (i) formalized controls and procedures required to ensure that information necessary to properly record transactions is adequately communicated on a timely basis from non-financial personnel to those responsible for financial reporting, (ii) segregation of duties in our accounting function, and (iii) monitoring of our internal controls.”

This, to us, suggests that not only do the players in the BLNK ecosystem present outsized risk to investors, but the ability of the company to accurately report its performance is insufficient to offset the risk of potentially risky conduct by those same players.

We believe that on this basis alone, BLNK presents significant downside risk to investors at these levels. In addition to the concerning origin of the company, we find that the current business has been struggling dramatically as well and yet management continues to receive hefty compensation.

Little growth in a growth industry, while Michael Farkas makes millions

In its 10-K, BLNK characterizes itself as a “leading owner, operator, and provider of electric vehicle (“EV”) charging equipment and networked EV charging services.” We question the basis of this claim.

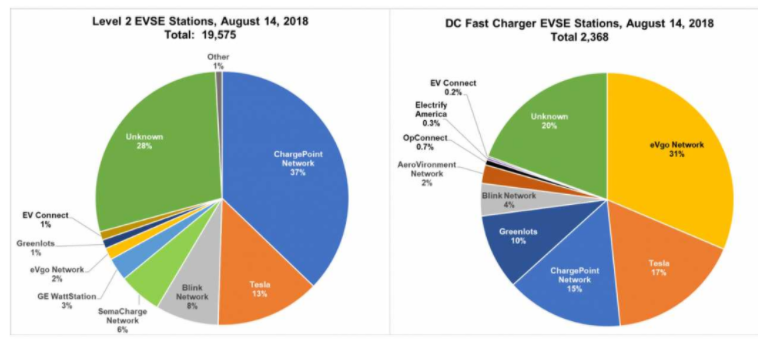

To begin with, BLNK appears to significantly lag its competitors in market share – for Level 2 EVSE stations (commercial chargers), BLNK’s market share is just 8% compared to competitors: ChargePoint’s 37%, TSLA’s 13%, and just 4% in DC Fast Chargers:

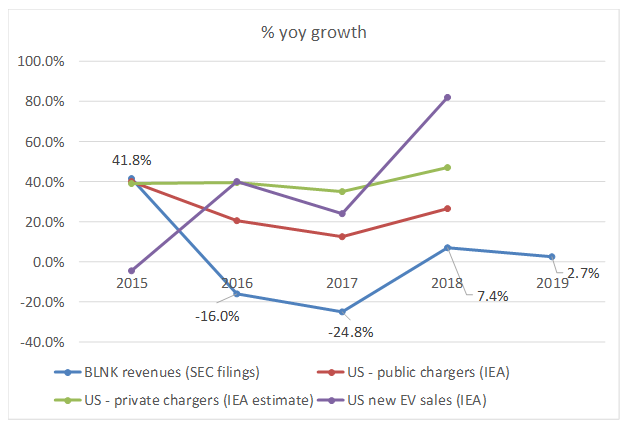

This market share differential appears to reflect BLNK’s inability to keep up with the growth of the overall EV and EV charging markets. According to the IEA, electric vehicle and charging station growth since 2014 has greatly exceeded BLNK’s revenue growth – BLNK’s revenues from 2014 to 2018 were down 3.8%, while the total of public and private chargers grew 277% in the same period:

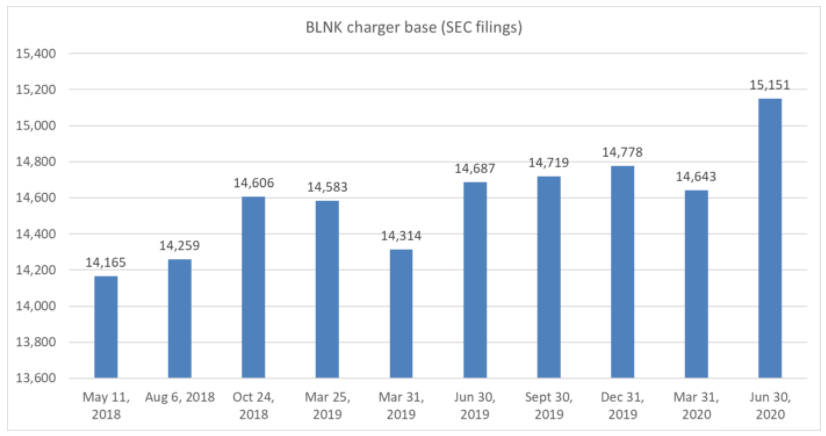

In fact, the number of BLNK charging stations have barely grown over the last two years, going from 14,165 at May 2018 to 15,151 at June 2020, a growth of just 6.9% – BLNK actually LOST about 135 charges in 1Q20 (and note the 269 drop in the charger count over 6 days in 2019):

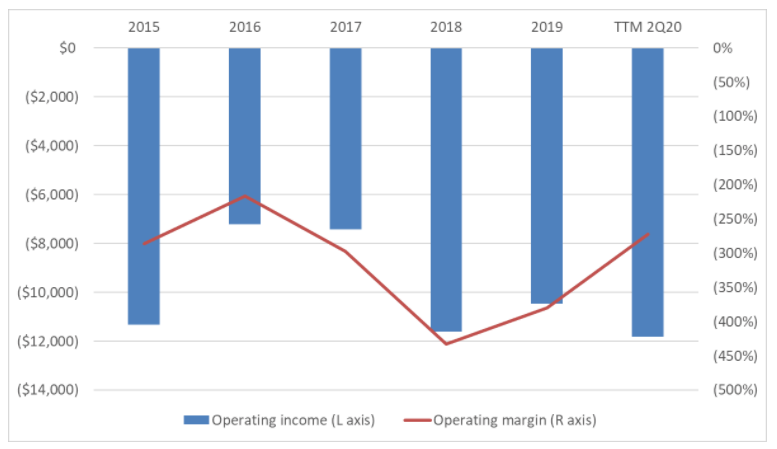

In the context of its most recent results, BLNK’s TTM 2Q20 revenues of $4.34MM is just 10% greater than its 2015 revenues of $3.96MM. Despite this growth, operating income has remained persistently negative at -$11.8MM:

For this performance, CEO Michael Farkas has made approximately $15MM since 2009, and in the period from 2015 to 2019, he has made close to $7.2MM.

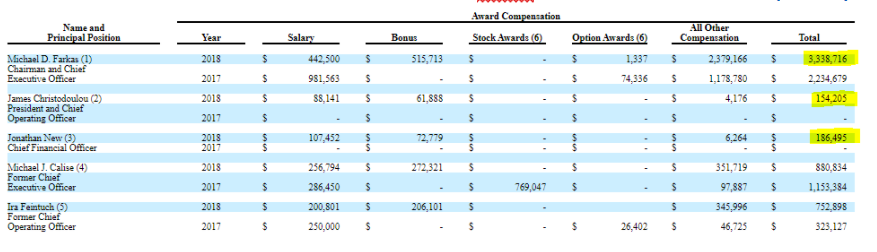

In 2018 alone, Farkas made 17.9x and 21.7x what BLNK’s CFO and COO, made, respectively:

In light of this misaligned compensation versus company growth dynamic, we sought to understand the reason why BLNK’s growth lagged its industry. We believe that this is due to acquisition of subscale assets from failing companies whose management teams either couldn’t successfully execute or simply attempted to defraud the government.

BLNK’s underperformance is rooted in acquisitions of sub-scale and bankrupt competitors

The question remains – why is BLNK’s growth underperforming its industry?

In 2013, BLNK embarked on an acquisition spree of four companies – Beam LLC, Synapse/EV Pass LLC, 350Green LLC, and ECOtality’s Blink assets – the Beam and Synapse deals were small, we believe, with Beam ($2.1MM in consideration) having just 40 chargers and Synapse ($892k in consideration) just 68. 350Green, at $1.2MM in consideration, came with its own management baggage:

It would follow that the substance of 350Green’s business may not have been very significant, if at all existent.

BLNK’s core assets come from the purchase of assets from bankrupt ECOtality

We believe that the answer to BLNK’s underperformance lies in the 2013 ECOtality acquisition that turned CGGI into Blink. In 2013, CGGI acquired ECOtality’s Blink-related assets (and subsequently changed its name in 2017) out of bankruptcy, picking up more than 12,450 Level 2 commercial charging stations, 110 fast-charging stations, and a network supporting them.

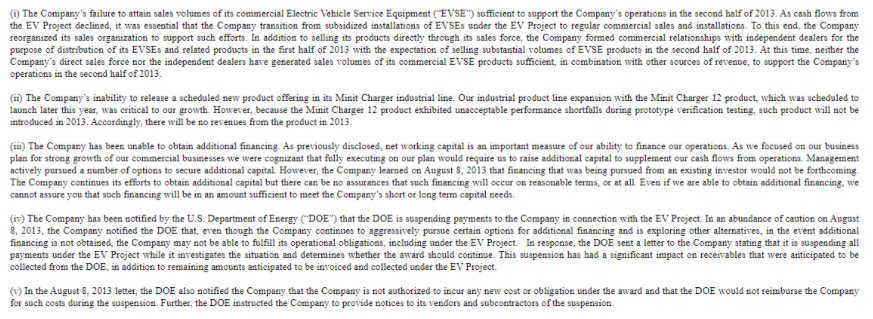

By that time, ECOtality had received over $100MM in Department of Energy grants, but its SEC filings suggested serious underlying business issues, the most critical being a “failure to attain sales volumes of its commercial Electric Vehicle Service Equipment (“EVSE”) sufficient to support the Company’s operations in the second half of 2013.”:

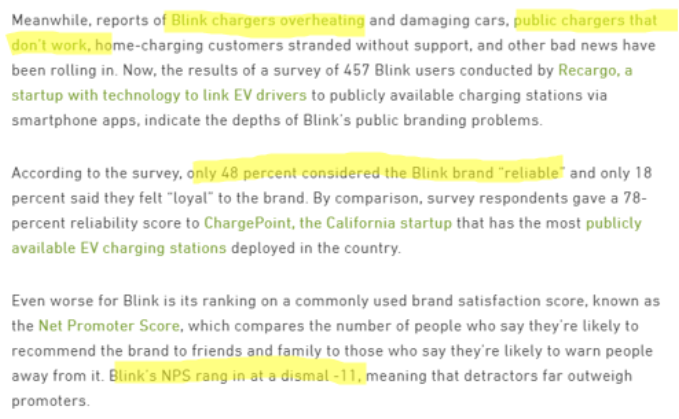

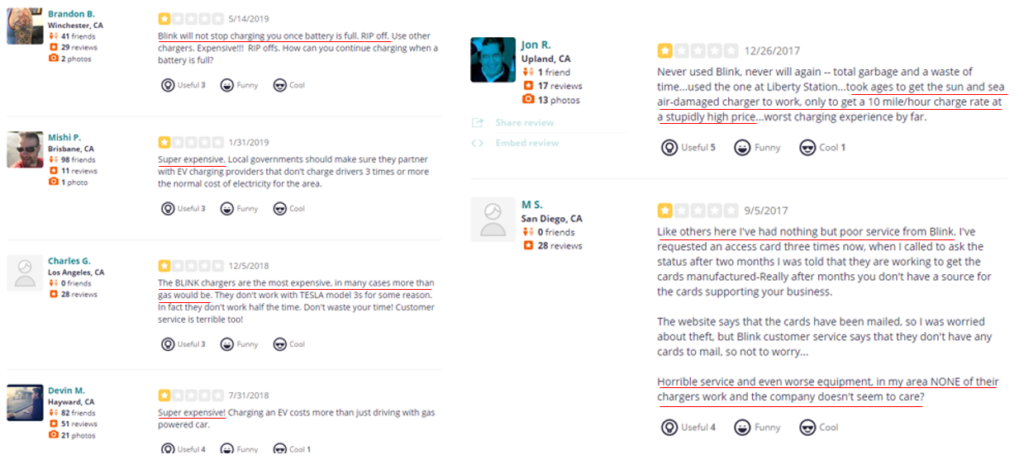

This lack of sales is likely tied to bad user experiences and low user reliability ratings dating back to 2013 related to the Blink brand:

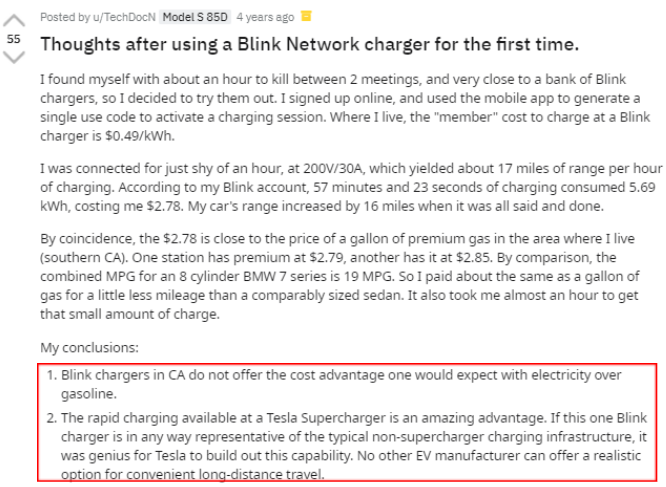

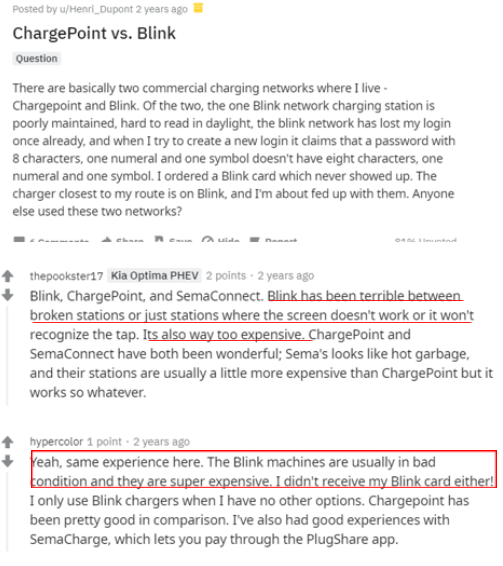

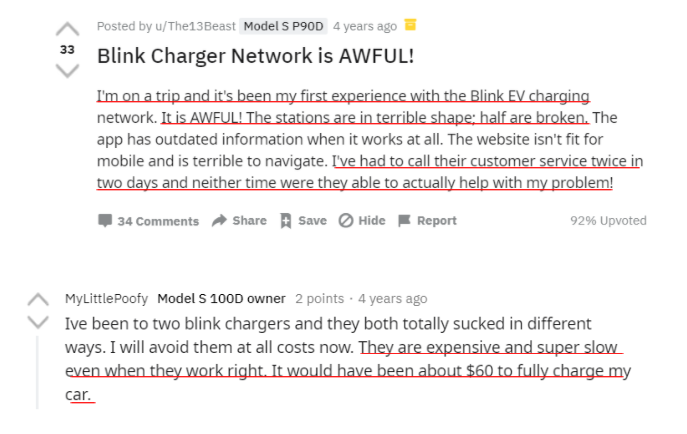

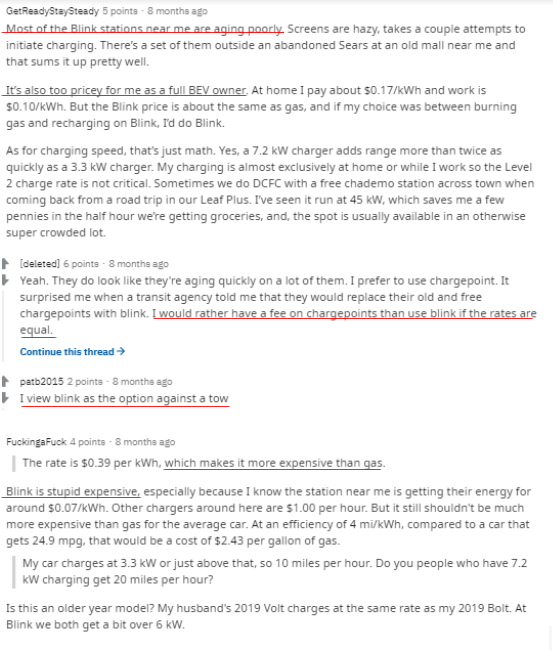

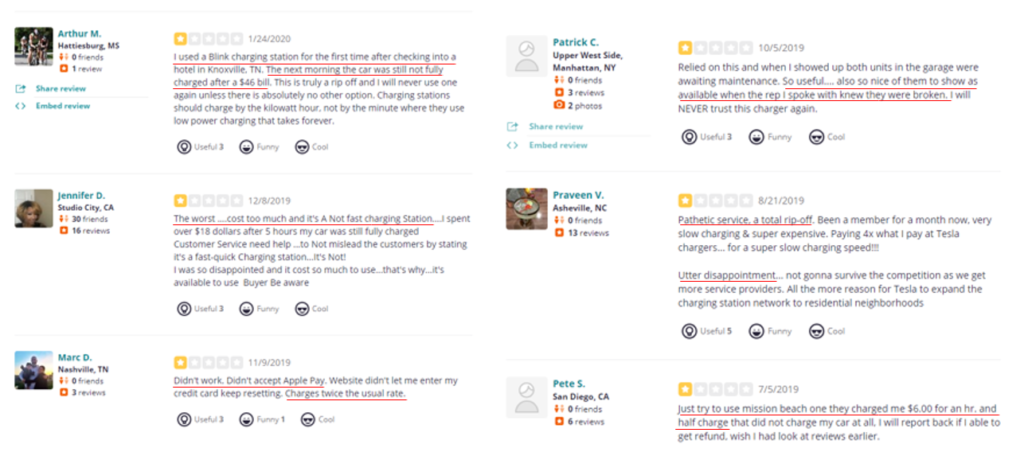

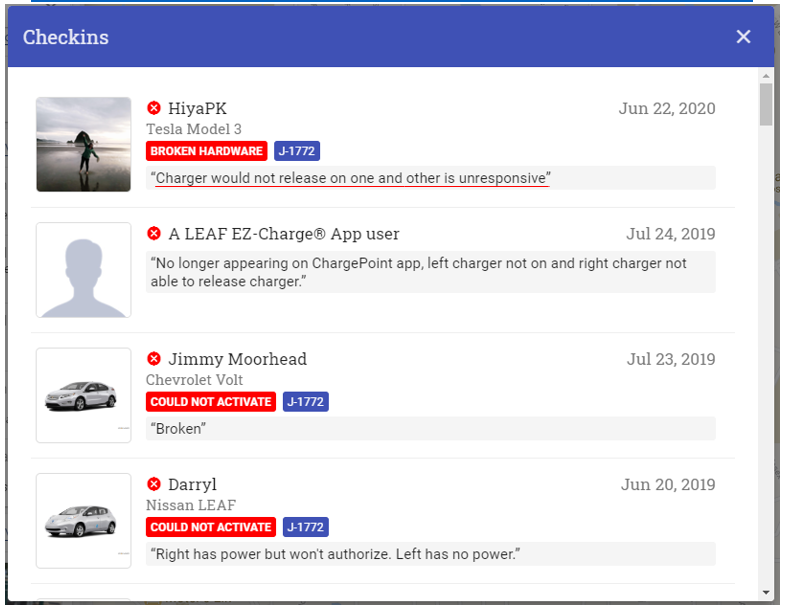

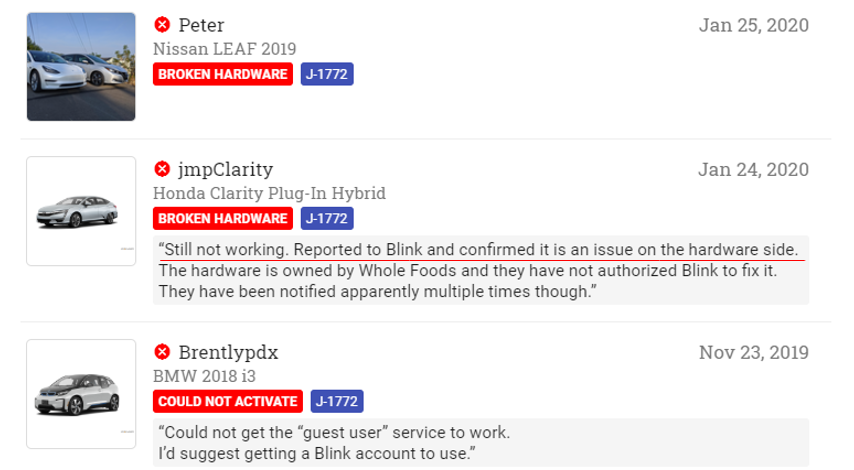

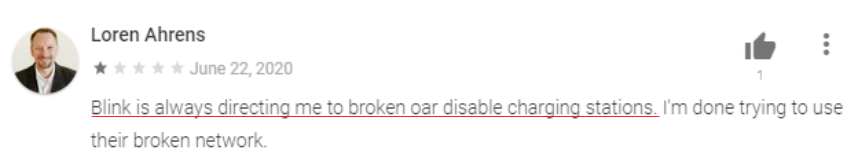

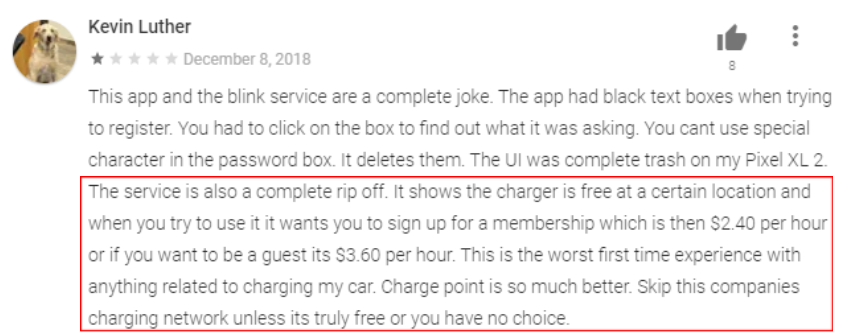

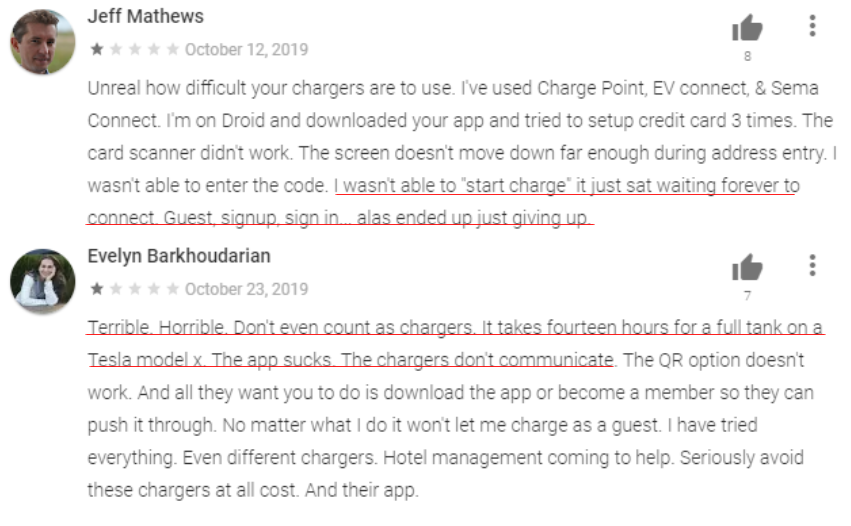

Our research on Blink today suggests that these issues persist and are the most likely driver of BLNK’s lagging results – users complain about broken chargers, long charge times, and high fees:

Reliability and functionality issues

Expensive and poorly maintained

The complaints and poor reviews are not limited to Reddit, however – people have reviewed individual stations in a similar manner:

A San Diego station reviewed on Yelp

Plugshare reviews on a Walgreens station in Elk Grove, IL

Plugshare review at Whole Foods

Even the BLNK app has bad reviews on the Google Play App store, with barely 2.5 stars

One of the biggest headwinds to BLNK’s growth is related to TSLA – in 2019, TSLA accounted for 78% of all US EV sales, making it the #1 seller of EVs domestically. TSLA drivers can access one of its 16,103 Supercharger fast charging stations and one of 23,963 regular TSLA chargers to charge their vehicles (both free to use for certain drivers). Said another way, the leading vendor of EVs already has a charging infrastructure tailor-made for its cars, significantly lowering the likelihood that TSLA drivers would choose a BLNK charger over a TSLA one.

The case of the missing chargers

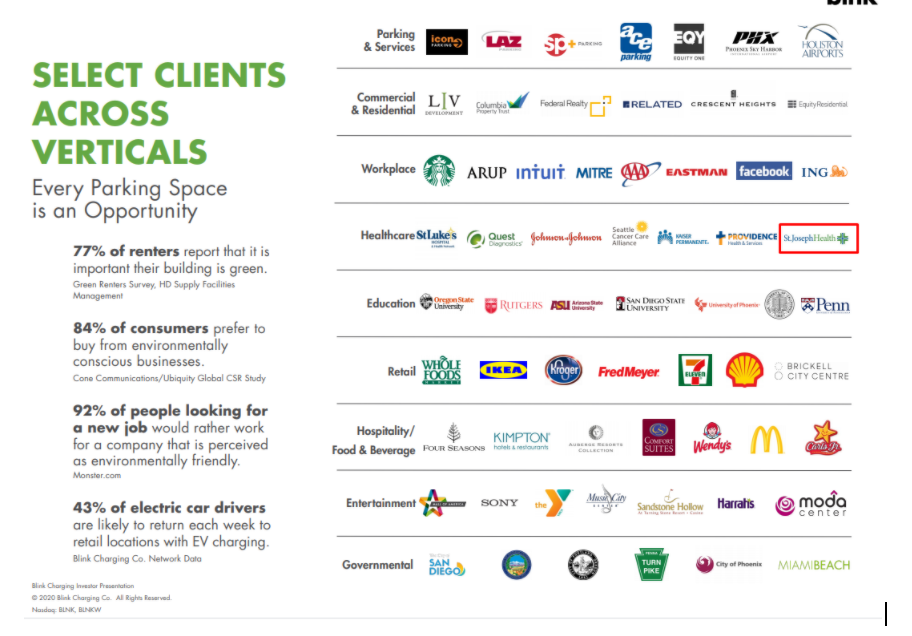

We spent quite a bit of time scouring BLNK’s charger map and its client highlights (in BLNK’s investor deck) to understand its infrastructure. What we found suggests that little effort has been made to grow the business. In using the charger map to count chargers at BLNK’s “select clients” (pasted below), we found several interesting data points that suggest BLNK has not expanded its network beyond what it acquired from ECOtality:

- Kroger – according to the charger map, BLNK has 52 chargers at Kroger locations. In this article, we learn that back in 2013, Kroger was planning to invest $1.5MM to expand its charger base from 74 to 225 through its partnership with ECOtality. Even though ECOtality went bankrupt in the same year, BLNK doesn’t appear to have pursued the partnership, and even saw total Kroger chargers fall from 74 to 52, a 30% reduction

- Fred Meyer – according to the charger map, BLNK has 63 chargers at Fred Meyer locations. Here, we learn that by 2015, Fred Meyer had installed 68 chargers across 33 stores. Even though the article quotes a Fred Meyer spokesperson saying it plans on adding another 18 chargers, we wonder if this ever happened – it is 2020, five years later, and the charger count at Fred Meyer locations has FALLEN from 68 to 63, about 7%.

This makes us wonder why BLNK management didn’t capitalize on these opportunities that it inherited from the ECOtality deal. But we found something even more unusual at St. Joseph, a healthcare organization based in California which BLNK claims as a client:

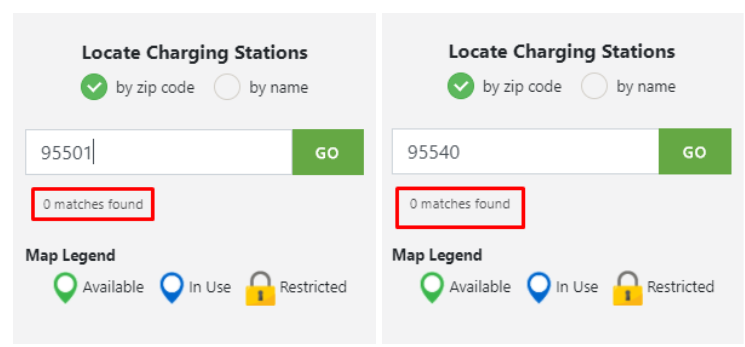

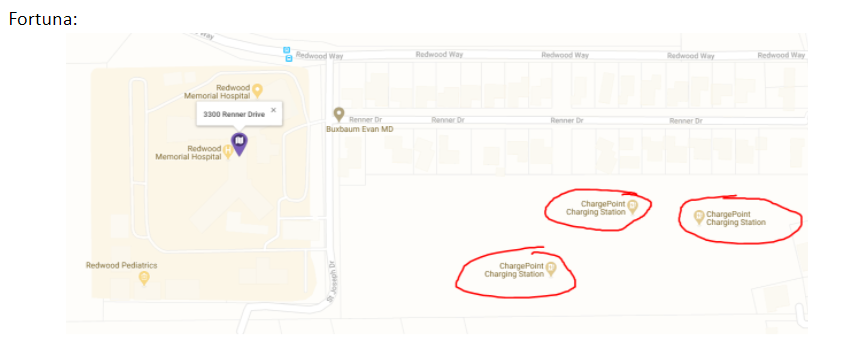

St. Joseph has just two hospital locations, one on Dolbeer Street in Eureka, CA 95501, and another on Renner Drive in Fortuna, CA 95540 – but neither location has a BLNK charger, according to BLNK’s own site:

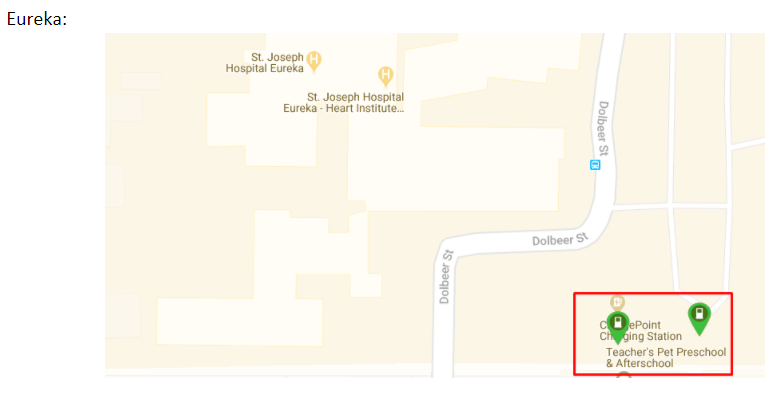

Plugshare actually just shows competitor ChargePoint’s stations at the Eureka and Fortuna locations:

The Redwood Coast Energy Authority, which “is a local government Joint Powers Agency whose members include the County of Humboldt; the Cities of Arcata, Blue Lake, Eureka, Ferndale, Fortuna, Rio Dell, and Trinidad; and the Humboldt Bay Municipal Water District,” would be the governing organization for charging infrastructure in this geography – IT DOES NOT MENTION BLINK CHARGERS IN ITS DESCRIPTION OF LOCAL CHARGING INFRASTRUCTURE.

We wonder why BLNK would show St. Joseph as a client when it doesn’t appear to be – more importantly, what does this say about the rest of the client list? We believe that this could indicate that the number of BLNK chargers is potentially overstated.

This, in our view, combined with poor user reviews about charger reliability, maintenance, and price does not bode well for the future prospects of the company – we believe that BLNK will continue to underperform the rapid growth in the EV industry at the ultimate cost to the shareholder.

Conclusion & valuation

In this note, we laid out several key findings that we believe makes BLNK a seriously risky investment that is likely to disappoint investors:

- CEO Michael Farkas’s seeming proximity to individuals charged by the SEC with pump and dump schemes

- A richly compensated CEO despite revenue significantly lagging industry growth and persistently negative profitability

- Asset base (chargers) appears to be the legacy assets of failed or bankrupt companies

- Ongoing user complaints about BLNK’s product stretching as far back as 2013

- Churn at key customers, and a potentially overstated charger base

- No intellectual property related to the underlying charger technology

We believe that the underlying business here is not positioned to compete with its peers and thus will not “catch up” to industry growth. We believe that the stock price run from approximately $2 in June to approximately $10 today should be considered skeptically given the history of the individuals involved here.

At 46x FY20 revenues, its valuation strains credulity. The business is significantly unprofitable with what we believe are limited prospects to catching up to the EV industry broadly and has hemorrhaged an estimated $115MM in FCF since 2010.

Given this, we believe the business should be valued at its liquidation, or book value, of just 17c in a downside scenario and at $2 a share in a bull case scenario (basically where it was before this non-fundamental move). The average of our price targets produces a base case target of $1.09, a drop of 91% from the 8/18/20 close.