Portfolio manager summary

- Beam Global (BEEM), formerly Envision Solar, sells the EV ARC, a solar-powered EV charging station whose main customers have been government entities, accounting for the majority of revenues

- We believe two recent business press releases that were part of driving the stock recent parabolic move overstate reality – one gives us DÉJÀ VU as we believe BEEM recycled a 2017 item for one of these announcements

- Gov’t entities have reduced their Beam spend – for example, once mission critical to BEEM’s revenues, NYC has not placed a new BEEM order since 2018! We dug up budgetary filings that suggest this trend will continue

- We believe and show that EV ARC’s impracticality and performance is the primary cause of falling orders – imagine our disbelief when we found out that EV ARC costs almost 100x more than some residential chargers but charges at a slower rate!

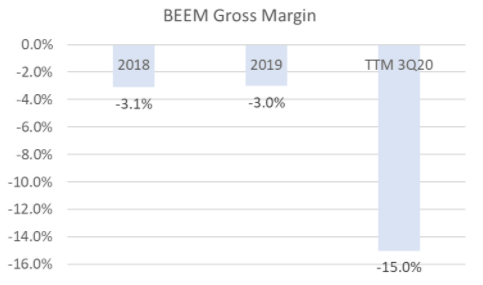

- Not only that, but the EV ARC may never be profitable, with gross margins ranging from -4% to +8% (solar company median is almost 20%), and unlikely to ever be profitable given its revenue outlook

- If you can’t make it…just stop disclosing it…management stopped disclosing backlog (forward indicator of revenue) after it fell over 50% in the two years leading to 2Q20 – this affirms our view that topline growth is challenged

- But have no fear, the management team is unusually well compensated. Between 2010 and 2019, the CEO + CFO compensation accounted for about 1/3 of cumulative revenues

- Both the current CEO and CFO were senior executives at companies that had to restate their financials

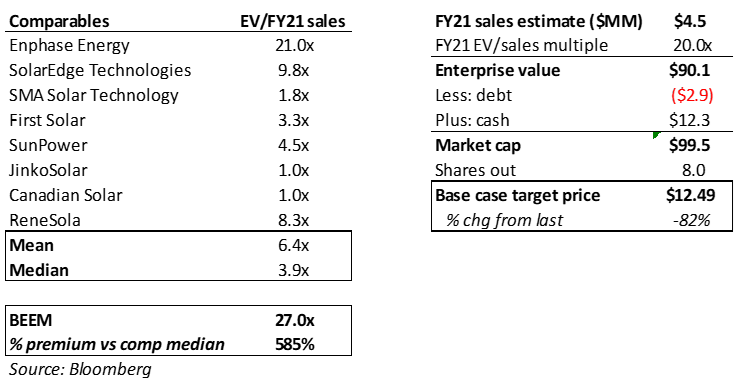

- BEEM trades (undeservedly, in our view) at a massive premium to successful, mature, solar companies with real revenues like Enphase, SolarEdge, and First Solar. Median EV/Sales for the peer group comes in at 3.9x, compared to 27x for BEEM

- A disappointing margin profile and a bleak revenue outlook paints an impossible path to profitability – we assign BEEM a target of $12.49, down 82% from the last close.

This isn’t a BEEM of light

Beam Global (BEEM), formerly Envision Solar, primarily manufactures and sells solar-powered EV charging infrastructure. BEEM’s primary product is the Electric Vehicle Autonomous Renewable Charger (EV ARC), which is effectively a carport with solar panels mounted on top. The EV ARC line includes a frame, panels, and battery to which a purchaser can connect an EV charger of their choice:

Source: BEEM

BEEM is the product of a 2010 reverse merger into a shell company known as Casita Enterprises. At the time, BEEM’s founder, Robert Noble, was CEO, and the company had a rather sordid set of allegations against it, which includes lying about installation contracts to attract investors:

Source: Casita 8-K

While a distant memory, we’ve long believed that zebras don’t change their stripes – the reverse merger history plus the 1460% stock price performance over the last year caught our eye. We believe that BEEM’s rocket ship stock performance is the result of investor optimism about the renewables space magnified by price insensitive ETF purchases of BEEM stock, but that this excessive excitement for BEEM is largely unwarranted. We also believe that management quality remains unchanged from the Noble days.

In this report, we explain our views on BEEM’s unprofitable products, its falling revenue outlook, disappearing forward-looking disclosure, excessive executive compensation, and troubling management histories.

These factors lead us to assign a $12.49 price target to BEEM’s stock, down ~82% from current levels.

“All the time our customers ask us, ‘How do you make money doing this?’ The answer is simple – volume.”

Very few companies we have analyzed have been so kind as to provide unit-level cost economics, but BEEM does. Below, from its 2018 10-K, are two tables which outline the cost of goods for two versions of the EV ARC:

Source: 2018 10-K

What we see here is that GAAP gross profits for the “average” and “least profitable” EV ARCs are 4% and -8%, respectively – this is driven in part by what we would view as a large portion of variable costs with volume-based fixed cost allocations.

As an aside, our analysis suggests that some of BEEM’s largest orders have been for the “least profitable” EV ARC, based on back of the envelope math:

- In September 2018, BEEM received a $3.3MM order for 50 EV ARCs from New York City, or an average price of $66k per unit

- In September 2020, BEEM announced a $2MM order for 30 EV ARCs from Electrify America, or an average price of $66.7k per unit

Despite this profitability profile, BEEM says, “We have assumed in the past, and continue to assume, that our sales will increase and will, as a result, reduce the impact of our per unit fixed cost contributions.”, implying that revenue growth will improve gross margins. This sentiment is repeated in the 2019 10-K: “As our business continues to grow, we expect to see an improvement on our gross profit through better utilization of our manufacturing facility.”

Despite this unit level disclosure, BEEM has not yet come close to achieving the GAAP gross margins it claims for each of these units, suggesting that revenue levels or mix are worse than management hopes (in other words, likely below the assumptions used in the above charts):

Source: Company filings

Notably, management never updated the unit economics for the EV ARC in subsequent 10-Ks. If unit profitability were improving, wouldn’t management want us to know that? (Note to reader: the company has put out 66 press releases in 2020, one would think if gross margins improved, we’d hear about it)

The company’s performance thus far, and our view of the future, suggest that further revenue growth needed to achieve positive gross margins is unlikely, but before we discuss that, let’s put some context around BEEM’s gross margins.

BEEM’s actual gross margins on a consolidated and unit basis as disclosed in the 2018 10-K put it firmly at the bottom of a peer group of solar component manufacturers:

Source: Bloomberg and company filings

On this basis alone, we believe that BEEM has a very deep hole to dig itself out of to come close to matching peer group profitability. In the rest of this report, we show that BEEM has thus far failed to achieve any revenue scale and explain our view that BEEM is unlikely to do so.

When the trend is not your friend: Municipal contracts that made up over 50%+ of revenues are starting to fade

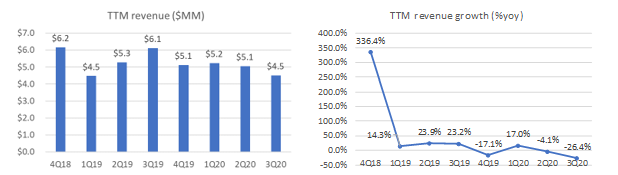

In BEEM’s own words, “As our business continues to grow, we expect to see an improvement on our gross profit through better utilization of our manufacturing facility.” The problem here is that the business has stopped growing. After putting up 336% growth in FY18, BEEM’s revenues have been trending down dramatically:

Source: Company filings

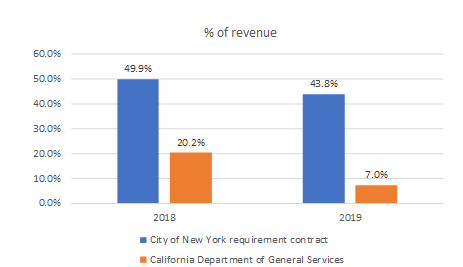

Our view is that this has largely been the result of falling or nonexistent deliveries at two critical customers – the City of New York and the State of California – over the last twelve months. The contracts, which do not have minimum purchase requirements, associated with these entities accounted for a meaningful portion of revenue in 2018 and 2019:

Source: Company filings

The New York City contract appears to be a cause for concern – after receiving a $3.3MM order from the city in September 2018, we believe that BEEM HAS NOT RECEIVED ANY NEW ORDERS SINCE THEN. After recognizing revenue for 34 units from this order in 2019, our examination of the filings for the first 9 months of 2020 suggest that BEEM has not recognized any further revenue from the city of New York:

“For the nine months ended September 30, 2020, revenues were $4,009,644, compared to $4,615,669 for the nine months ended September 30, 2019, a 13% decrease. Revenues in the nine months ended September 30, 2020 included a wide variety of customers, including several municipalities and state agencies in various states and in Canada, colleges, a large commercial business and two nonprofit organizations. We have also sold a variety of different products during this period, including our traditional EV ARC™, our new EV ARC™ 2020, a DC fast charging station for a California rest stop and the first two of three Solar Tree® solar-powered sustainable infrastructure products sold to charge large vehicles. This compares to revenues for the nine months ended September 30, 2019 where almost half of our revenue resulted from the delivery of units to one customer, the City of New York. We also sold two DC fast charging stations for California rest stops last year. Our shipments will continue to fluctuate each quarter due to the varying size of orders and timing of deliveries.”

Going deeper, BEEM’s own disclosures and those of New York City confirm our conclusion:

In the 2015 10-K, BEEM notes that it deployed one EV ARC to New York City in 3Q15

In the 2019 10-K, BEEM says as of March 2017 it had received an order of 36 EV ARCs from New York City, and in September 2018 received an order for 50 EV ARCs from NYC

The sum total of the above mentioned orders is 1 + 36 + 50 = 87 units, which matches to what New York City discloses as the number of EV ARCs deployed

Based on the fact that the number of EV ARCs deployed by the city match the number that BEEM discloses as being ordered from the city, we can conclude that no new orders have been delivered after the 2018 order. Does this imply that the NYC was unhappy with BEEM’s product?

We considered that NY might be an outlier, so we investigated California. For the California Department of General Services contract, we see a material deterioration through 2019:

Source: Company filings

On a total unit basis, BEEM delivered 90 units in 2018, but just 65 in 2019, down 28% year over year. Even though the company has not provided clear unit delivery numbers YTD2020, revenues for the first nine months of 2020 are down 13%, making it safe to conclude that units are also down for the same period.

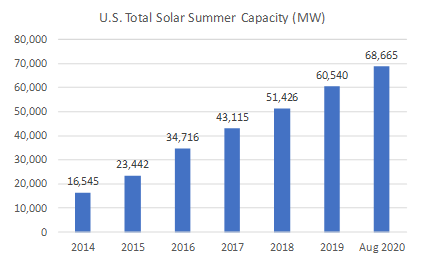

Declining Revenue in the Face of a Massively Growing Sector

To put this in context of the industry – while BEEM’s unit volumes have fallen from 2018 through 3Q20, U.S. total solar capacity has increased 34% (Dec 2018 to Aug 2020), meaning solar power capacity is growing, but BEEM is just not participating:

Source: US EIA

This deterioration in revenues from material contracts implies that BEEM would have to find new customers to fill these revenue holes – and they have, to some extent – but it’s come at the cost of BEEM’s profitability.

In February of 2020, BEEM announced a $2MM order for 30 EV ARC charging stations from Electrify America, of which 8 were deployed in 3Q20. This order equates to approximately $66k per unit…which happens to be the price point of BEEM’s “least profitable” product (as illustrated earlier). So while BEEM did find a new customer, it was for a product with -8% gross margins.

Source: 2018 10-K

In our next section, we reveal why we believe that BEEM’s future revenue growth is likely to be limited.

Significant revenue growth is unlikely to materialize

There are two main indicators that suggest BEEM is unlikely to experience a dramatic increase in revenues.

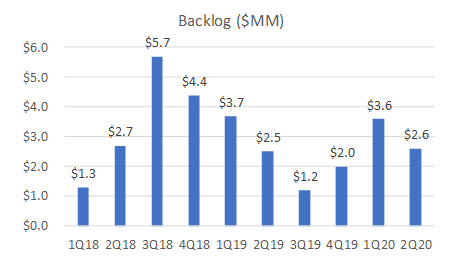

The first, and most significant, in our view, is the company’s backlog, which is typically a representation of orders to be delivered in the future. Through 2Q20, BEEM’s backlog is down over 50% from the $5.7MM peak in 3Q18:

Source: Company filings

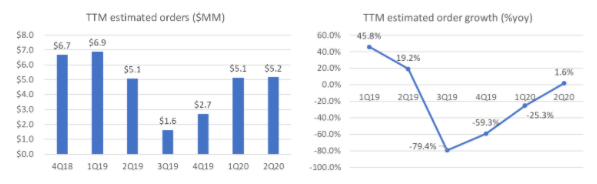

By analyzing the change in backlog and revenue booked in a quarter, we can estimate the dollar value of new orders, which are barely up year over year through 2Q20:

Source: Analysis of company filings (orders = EOP backlog – BOP backlog + revenue)

Unfortunately for investors, BEEM appears to have withdrawn this disclosure in 3Q20, which we would view as a negative indicator for the future. This is addition to eliminating quarterly unit delivery disclosures, leading us to believe that management does not want to provide critical transparency to investors.

If backlog was up, wouldn’t BEEM want you to know that? We can only assume that it was down yet again, and consequently BEEM decided to exclude it from its quarterly disclosure.

The second indicator for a less than rosy future is the state of BEEM’s customers. As we covered in our note on GreenPower Motor, COVID has had a negative impact on state tax revenue. For example, in January, California was predicting a $5.6B budget surplus – by May, that surplus had turned into a $54B deficit.

Similarly, for the state of New York, state tax revenues are down 17.2% through September 2020 compared to the prior year.

What this results in is flat to smaller budgets, meaning BEEM finds itself trying to sell to customers who have less dollars to spend.

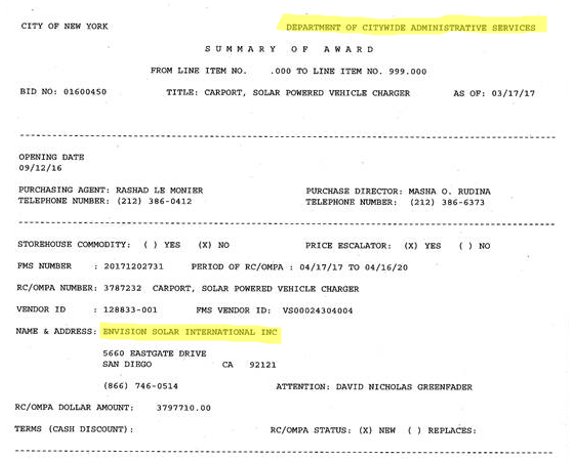

NYC budget dollars are downward trending

While New York City may be a moot point given it hasn’t ordered anything from BEEM since 2018, it’s still important to assess the city’s budget. The city division that has a contract with BEEM is the Department of Citywide Administrative Services, per the contract exhibit found in BEEM’s filings:

Source: Company filings

The trend in funds allocated to fleet services (where we believe BEEM’s products are included given their use in charging vehicles) is negative, down from $58MM in 2018 to just $31MM for 2021, a drop of 46% and not a good indicator for incremental spend:

Source: NY Department of Citywide Administrative Services

Customer budgets in California are also shrinking

We found several instances where named BEEM customers in California are reducing budget allocations to the departments most likely to purchase BEEM products.

- In 2018, BEEM announced the purchase of EV ARCs by San Diego County “for its electric fleet”. The Fleet Management Internal Fund’s budget is expected to shrink slightly in 2021 and 2022

Source: San Diego County Budgets

- The city of Long Beach has purchased EV ARCs and has been cited as a repeat customer. In this 2018 release, we learn that the agency responsible for the purchase is the Fleet Services Bureau. “The Fleet Operations Division is responsible for the administration and support of the Bureau’s budget, personnel, fueling, billing and operational needs of its staff.” The Fleet Operations Division’s budget for 2021 is down 8% from 2018

Source: City of Long Beach

- Tehama County, a March 2020 purchaser of EV ARC to provide free electric charging to citizens through its Carl Moyer Program, has seen budgets to the Moyer program fall 60% since 2018, inclusive of a significant increase to funds in 2020

Source: Tehama County Budget

- In July 2020, the city of San Luis Obispo, through its Air Pollution Control District, deployed an EV ARC charger. The 2021 budget for the Air Pollution Control District is expected to be down 9% from 2020:

Source: Air Pollution Control District

We believe that recent announcements are hot air and unlikely to translate into meaningful revenue

BEEM recently made two business announcements that would suggest potential revenue upside:

- 11/19/20: a GSA MAS contract award

- 10/21/20: a collaboration with the city of San Diego to provide free EV charging

Here, we’ll show you why we believe there is much less to these announcements than suggested.

The first, with the US General Services Administration (GSA), simply allows federal agencies to purchase EV ARC through the GSA Advantage website. Importantly, there is no volume commitment associated with this award. We would liken this to just getting your product added to a catalog where catalog recipients can choose to order your product.

Notably, in this release, BEEM CEO Desmond Wheatley notes that five federally funded labs and the Navy already use EV ARC:

“Five Federally funded National Laboratories and the U.S. Navy already use EV ARC™ products. It will be much easier to get follow on orders from them and new orders from other Federal agencies as a result of this contract vehicle being in place.”

Those five federally funded labs are the US Department of Energy’s National Renewable Energy Laboratory (NREL), Lawrence Livermore National Laboratory, Sandia National Laboratories in Albuquerque, Sandia National Laboratories in Livermore, and Idaho National Laboratory and while they can certainly now use the GSA website to place orders, their 2021 budgets don’t suggest an increasing ability to pay.

Livermore and the Sandia labs have 2021 budgets 25.5% and 12.6% less than 2020, respectively, while NREL and Idaho are flat.

Source: Department of Energy funding by site

In fact, the DOE’s budget for “Energy Efficiency and Renewable Energy” is down 74% in 2021:

Source: Department of Energy Funding by Appropriation

Stepping even further back, the DOE’s overall budget for 2021 is 8.2% below 2020’s budget. Unless other federal agencies decide to make up for budget shrinkage by BEEM’s existing federal customers, we do not believe this announcement will translate into meaningful revenues.

We believe that the above shows a fairly clear trend that budgets of key municipal and government customers are tightening and less funds are available to purchase EV ARC products.

Is this déjà vu?

The San Diego announcement, in our view, bears a striking resemblance to a 2017 announcement that doesn’t appear to have gone anywhere.

In this most recent announcement, BEEM says it is collaborating with the city of San Diego to offer “free sustainable charging to the public” through a “a public-private partnership with a corporate sponsor who will receive global naming rights to the network and highly visible corporate brand placement on the EV ARC™ units”:

Source: Press release

In 2017, in fact, BEEM made an announcement that it had engaged Outfront Media to procure a “naming rights sponsor for the EV ARC™ charging station network throughout San Diego”:

Source: Press release

Strangely, it does not appear that this amounted to anything – we were unable to find a subsequent release that Outfront and BEEM had found a naming rights sponsor. We would assume, based on this and the fact that the “corporate sponsor” story is back in 2020 that the initial 2017 effort didn’t amount to anything.

These two announcements are strikingly similar – both mention a to-be-determined corporate sponsor, suggesting an intent to do business with a corporate sponsor rather than anything actually set in stone.

Given that the 2017 announcement doesn’t seem to have amounted to anything, what’s to say that the 2020 announcement will? Is it simply possible that corporate sponsors don’t have interest in spending over $60k per device for marketing purposes?

These indicators, plus BEEM’s considerable decline in backlog and decision to eliminate the backlog disclosure lead us to believe that revenue growth for the foreseeable is unlikely to reach the sell-side’s eyepopping revenue growth estimates of 259% in 2021 and 84% in 2022 (Bloomberg).

Is EV ARC an uncompetitive product?

We believe that it’s important to understand the why behind the apparent stalled-out growth and limited product demand and future we have outlined above.

When we first started looking at the EV ARC, we were unable to find any real competitors in the solar powered EV-charging carport category. This led us to two potential conclusions: either BEEM had bottled lightning and no one was able to compete with them, or the product category itself was, for some reason, unattractive. Unsurprisingly, our conclusion is firmly in the latter camp. A quick look at the EV ARC’s capabilities provides insight into why – according to BEEM’s own fact sheet, EV ARC only provides up to 245 miles of daily range:

Source: BEEM

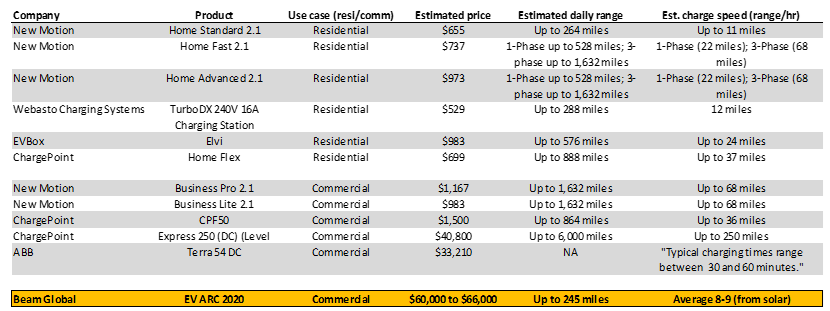

Our interpretation here is that a single EV ARC can provide a total of just 245 miles of range per day – so if two cars are using the charger over the course of the day, they split that 245 miles of range. This is a function of the solar panels’ ability to generate electricity, and compares unfavorably with traditional, on-grid stations both in range and price:

Sources: New Motion catalog, New Motion Business Line, New Motion Home Line, EV Solutions, EV Solutions Store, CarPlug, EVBox, ChargePoint Home, ChargePoint HomeFlex, ChargePoint Express 250, ChargePoint CPF50, Charging Shop, Beam Global

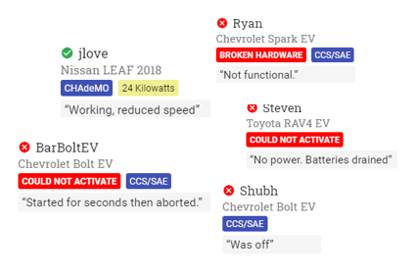

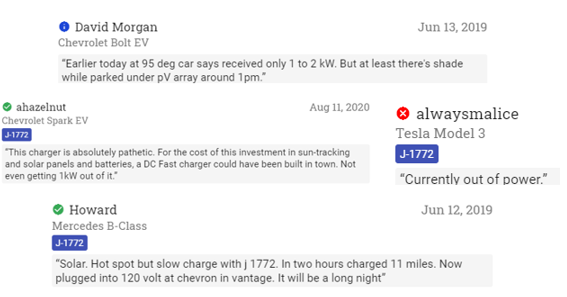

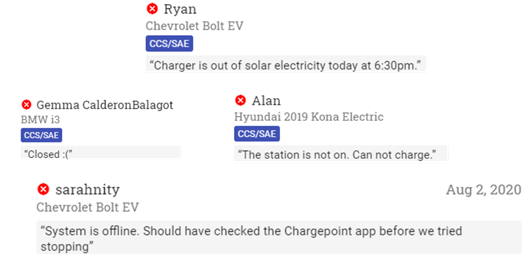

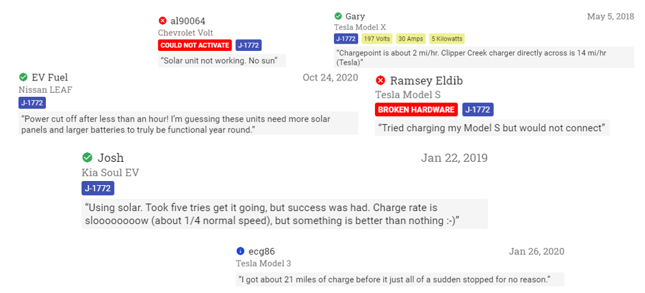

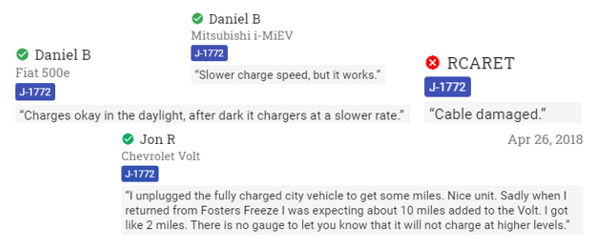

The rate of charge for the EV ARC is dramatically slower than the other commercial and residential chargers, which we would imagine doesn’t provide a great customer experience. In fact, we reviewed user feedback from six EV ARC stations we were able to find on PlugShare, and while many users were able to use the stations, common complaints were related to stations not working or slow charging:

Camp Roberts Northbound Rest Area

Ginkgo Petrified Forest – Trees of Stone Trailhead

Camp Roberts Southbound Rest Area

The economics of an EV ARC don’t appear attractive to us, either – a survey of the EV ARCs in the Fresno area shows that they charge $0.43/kWh for a charge. Assume we are attempting to fully charge a 75 kWh TSLA Model S, the owner would pay 75 * $0.43 = $32, and the EV ARC would be tapped out. Based on this 43c/kWh pricing, the revenue for the EV ARC is capped at ~$30 a day, or $10,950 a year. Assuming zero operating costs (which is obviously unrealistic), that’s an almost 6-year payback period, best case, for an EV ARC.

Unsurprisingly, BEEM has received criticism for its product given this dynamic. As early as 2014, BEEM (then Envision), received criticism for being too expensive at $40k (it’s now over $60k!):

Source: WIRED

Aside from being expensive, it appears that off-grid commercial charging presents another costly problem – wasted capacity. The changing dynamics of traffic flow in cities or employee presence in corporate lots make “sizing a suitable generation system – without massively overbuilding capacity – very difficult.”

According to this article, you can easily install enough solar-powered EV charging for your “busiest days”, but then your system is underutilized on other days:

Source: TheDriven.io

Given this, if a customer really wants solar-power EV charging, they are either going to optimize capital returns by planning deployments based on lower utilization (vs “busiest days”) or push for pricing that makes wasted capacity less of an issue.

We think the latter is where solar power EV charging is headed – as an example, just a few days ago, we learned that the Minnesota Pollution Control Agency is planning on spending $170k on 22 Level 2 charging stations, but will reward developers who include solar panels or other renewable power sourced into their stations:

A municipality is offering $170k to purchase 22 charging stations, INCLUDING SOLAR PANELS, amounting to an average price of $7727 per station. BEEM, at over $60k a station (and still barely/not profitable on a unit basis at these prices), is entirely unable to compete in such situations. BEEM would only have to drop their pricing by ~87% in order to be competitive in this situation

Despite this difficult dynamic powering anemic future revenue growth, history tells us that management will be well compensated regardless.

Great work if you can get it

Since its 2010 reverse merger through 3Q20, BEEM has generated approximately $27MM in revenue. Of that, an eye-popping 99.7% has gone to operating expenses:

Source: Company filings

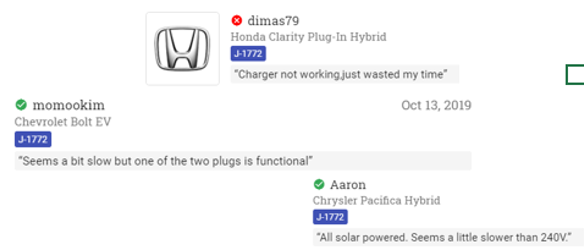

The prime beneficiaries of this operating spend have been BEEM’s current CEO, Desmond Wheatley, and CFO (formerly Chris Caulson and currently Katherine McDermott). From FY10 to FY19, the period for which compensation data is available, operating expenses were 106% of revenue. Compensation paid to the CEO and CFO were approximately 30% of revenues during this period.

CEO Wheatley’s comp alone accounted for almost 20% of revenues from 2010 to 2019:

Source: Company filings

While BEEM’s revenues have fluctuated dramatically over the last 10 years, Wheatley appears to have done just fine.

In addition to what we believe is excessive executive compensation, we have other concerns about certain members of the executive team and board.

The C-suite and two restatements

In something we typically don’t see in our work, both the CEO and CFO of BEEM were at companies that both had to restate their financials.

From 2000 to 2007, BEEM’s longtime CEO, Desmond Wheatley, was in leadership at Wireless Facilities, Inc. (WFII), now Kratos Defense Solutions. He was a VP from 2000-2002, and from 2002 to 2007 was the President of the Enterprise Network Services Segment (ENS):

Source: LinkedIn

On August 4, 2004, WFII announced it would have to restate its financial statements for the years 2001 to 2003, primarily as a result of a “recent analysis of contingent tax liabilities primarily in foreign jurisdictions”. WFII estimated that the “preliminary estimate of the impact of the adjustments is between approximately 3 – 8% of net income or loss for any given year from 2000 to 2003 for an aggregate increase of expenses of $10 million to $12 million.” In the three months preceding this announcement, company insiders were alleged to have sold over $60MM in stock. When the company released its amended 10-K a month later, however, net income was reduced by a total of $33.6MM, and the drivers of the restatement were a broad range of issues:

Source: 10-K/A

The division Wheatley was president of, ENS, was also caught up in the restatement – its 2003 revenues were reduced from $43.2MM to $41.1MM, or down 4.9%. While Wheatley was never mentioned in the ensuing lawsuit, his position in leadership of a segment that had to restate numbers is, in our view, a cause for concern.

CFO Katherine McDermott, who joined in July of 2019, was at Lantronix from 2000 to 2005 as VP of Finance when the company had to restate its financials. Lantronix announced that it expected revenue reductions of less than 15% for fiscal 2001 and 2002. Lantronix later disclosed it was the subject of an SEC probe, and, in 2006, the SEC sued Steven Cotton, Lantronix’s CFO during this period:

Source: SEC

Let us be clear, Kathy McDermott is not mentioned in the restatements or SEC complaint. It is, however, troubling to us that Kathy was the VP of Finance at Lantronix, potentially working for CFO Steven Cotton.

In both cases, neither Wheatley nor McDermott were implicated in the suits that resulted from the restatements. They were, however, indisputably in senior roles in their organizations when the above-mentioned events transpired. We believe this should be a red flag for investors.

Unhappily EVer after

We believe BEEM presents significant risk to retail investors, and that the 1460% increase in the stock price over the last year on deteriorating fundamentals is entirely unjustified.

The Mariner instant replay shows that:

- BEEM sells a product whose profitability has thus far been minimal

- BEEM’s revenues, after growing in FY18, have since slowed considerably, leading to stagnant margins

- BEEM’s backlog has shrunk, and the company has stopped providing backlog disclosure

- BEEM’s municipal customers are facing budget headwinds

- EV Arc’s performance is far behind that of on-grid systems, despite a much higher price tag

- Despite all this, BEEM’s executive compensation has soaked up ~30% of revenues since 2010

- Both BEEM’s CEO and CFO had leadership roles in companies that had to restate their financials

In light of these factors, we do not believe that BEEM can achieve the lofty sell side estimates found on Bloomberg, which call for revenues of $20.2MM in 2021 and $37.1MM in 2022, up 270% and 72%, respectively, from the prior year periods.

Given current backlog and customer trends, we think revenues will be flat in 2021 (to TTM 3Q20) at best. Assuming multiple compression from BEEM’s eye-popping 27.0x EV/Sales multiple (a 585% premium to the group median multiple) to 20x EV/Sales, we get to a price target of $12.49, down 82% from the last close: